Hi All,

I hope you all are doing well and welcome to Dozen Worthy Reads. A newsletter where I talk about the most interesting things about tech that I read the past couple of weeks or write about tech happenings. You can sign up here or just read on …

I hope y’all had a wonderful start to 2022 and I hope you have a wonderful year! Today i’m going to cover what I like to call a Solo Angel (investor). Lets get into it!

Intro

If your commute was anything like mine pre-covid (1:45 each way in the Bay Area from the South Bay to SF, so much for “tech solving problems”, right?) you probably had no time to think about seed investing, crypto, or even what was happening with your retirement account which was gathering interest (or dust) depending on what you did with it. At the same time IRA’s were growing like crazy. The Total assets of traditional Individual Retirement Accounts in the United States went up from $2T in 2000 to $10+T in 2020.

However the past three years have brought together a number of interesting factors resulting in an “Investment rush” as per WSJ. Per the article “Investors in 2021 have pumped a record $93 billion into early-stage U.S. startups through Dec. 15, triple the amount from five years before”

Before we start; NONE of this is investment advice; I am not a professional investor; invest at YOUR own risk!

Welcome to the new world where everyone is an investor. My own journey with some basic seed investing began with an Angelist syndicate started by some of my ex-Indeed colleagues. Needless to say I invested very small amounts with the intent of portfolio diversification. I mean don’t get me wrong I do want to support entrepreneurs too, but people seed invest in order to make $ and that was/is my goal. Chances, of course, are there is a very small chance that any of these investments make it big. For me in addition to invest, this was educational in a way; spending my “additional free” time doing things I would not otherwise be able to do

I am, however, one data point and I have noticed pretty much everyone I know calls themselves a “seed investor” on LNKD … of course in order to differentiate themselves from everyone else. Now if you want to look cool as well, you can do it for as little as $100 as I will show you shortly.

Seriously though, at this point, $ is not in short supply, good vetted ideas are ..

Revolution

2021 was the year of meme stocks, GME, Crypto prices reaching the highest they have ever been. As Conrad Bastable writes in The Full Stack of Society :

Working “Below the API” is the terrifying dystopian endgame vision driving the support in Silicon Valley for redistributive programs like Universal Basic Income, and Sam Altman wrote a prescient essay way back in 2013 about the political tensions of a low-growth Zero-Sum environment. The optimistic take is that “API-based” software businesses provide flexible employment, cash-on-demand-in-exchange-for-elbow-grease, and a way to provide for yourself and your family that didn't exist ~10 years ago.

All true, by the way!

The pessimistic take is that working Below the API closes the path to Wealth for an entire Class of people as labor trends towards Perfect Competition, towards Zero Economic Surplus, towards a world where the serf peasant worker can't afford to purchase the tools she uses to work and must instead rent them from her employer at an ever-increasing-margin, i.e. pay a feu/fee, to be able to feed herself.

If a large swath of our society is truly working “below the API” we’d expect them to get pissed (read the entire article for context, very nicely written)

Capital & Interest rates

Lots of people in the United States got stimulus checks and if you had extra $ keeping it in the bank account was kinda dumb (inflation much higher than savings rate). Technically, if you keep your $ in a savings account your dumbass bank is the one making money and a lot of people realized this and decided to trade current consumption with future consumption but instead of saving put all this money into Robinhood, Public, Titan, Crypto. I mean what the hell put your $ in and HODL

Apps and PFOF (free trades!)

Have you ever tried to use Fidelity.com to invest? I mean the interfaces are so bad and so confusing that it's almost like they don’t want you to invest. A long long time ago I had a Fidelity PAS (which stands for Portfolio Advisory Services) for which they want you to pay them ~125 bps. Let me just put it this way, they can't do sh*t for you, more than you can. In my humble opinion unless you are extremely wealthy all these kinds of investors just eat into your retirement or investments and skim off the top. So what are you to do if you are a small investor? Welcome to an underserved market as Clayton Christensen termed it:

Disruption can come in different varieties: Low-end disruption and new-market disruption.

Low-end disruption refers to businesses that come in at the bottom of the market and serve customers in a way that is "good enough." These are generally the lower profit markets for the incumbent and thus, when these new businesses enter, the incumbents move further "upstream." In other words, they put their focus on where the greater profit margins are.

New-market disruption refers to businesses that compete against non-consumption in lower margin sectors of an industry. Similar to low-end disruption, the products offered are generally seen as "good enough," and the emerging business is profitable at these lower prices.

The main difference between the two types lies in the fact that low-end disruption focuses on overserved customers, and new-market disruption focuses on underserved customers.

The new age of apps are easy to use (Public, Robinhood, Stash, M1, Webull) and they were able to capture a lot of interest and attention among this segment. They made investing easy .. too easy as some folks claim. I’m not going to argue this one

Passive to Active

As this article from a16z says :

However, in recent years we’ve seen momentum start to shift back towards active investing. The status-quo—passive-only investing strategies—is being challenged by newer generations of investors entering the market. The reasons behind this shift are part psychological, part structural.

So basically there are options across the entire stack depending on how you want to be involved. Passive to Active investing across the stack though in my personal opinion the passive investing products are somewhat similar. Product differentiation is no longer at the investment level (ie what stock, offering you provide) but to other kinds of differentiation such as Iris, which allows you collaborate with friends when you invest (Note : Very small seed investor in Iris)

Or Composer where you can do really complex stuff or follow other smart people who can do really complex stuff

This appetite for risk is not extending to not only incorporate active, passive, simple, complex but types of funds as well. Investors can now “buy” StockOps and RSUs from employees at companies using products such as EquityBee

The other differentiation is the kind of capital you can play with. Rather than current savings, you can now use your IRA to fund some of these investments. Companies such as Republic (seed investment), and AltoIRA (IRA investments) are allowing you to somewhat actively (or passively) invest in higher risk offerings

I mean this is the perfect bridge. Seed rounds are getting larger and larger and given the great resignation there are more people willing to try entrepreneurship as a route and more people quite willing to invest risk capital. Angelist syndicates don’t make it super easy to invest. The last 3-5 years have led to the rise of the Solo Capitalists who can move much faster. So basically there are now three entry points into seed investing

Find a Solo Capitalist who’ll take your $ (generally check sizes have to be larger so probably not for everyone)

Join an Angelist syndicate (not a bad route but you have to have a group of people you want to invest with)

Become a SoloAngel (invest on your own for as little as $100)

Trying this out …

So.. naturally I was intrigued, curious, and full of FOMO (the latter mostly) so I decided to explore this a bit more. I experimented with Republic and AltoIRA (Seed and Crypto) and they were both interesting products

I started with Republic and Republic allows you to invest as little as $100 and provides you with multiple options to invest.

For example you can invest in Real Estate directly instead of an REIT.

The best thing about Republic though is the ability to invest using AltoIRA. In my case I decide to move a small portion of my IRA into Alto to invest in startups and to invest in Crypto. The transfer process was a bit painful but Alto’s support team was super helpful (I mean Betterment needed paperwork mailed!!!!! - Anything to stop you from leaving). Anyway the funding took about 3-4 weeks from my Betterment IRA and I was ready to invest.

So I went back to Republic and started looking at investments. Republic really organizes the information very well. Oonee for example, which does modular bike parking (they look like mini condos to me ;)) shows you the basic information and more information on the deal itself. The Pitch page contains the pitch deck and the Discussion tab allows you to ask questions (which is normally harder to do unless your check size is big. You can also look at Reviews to see why other people invested which makes it a great use case for a Solo Angel

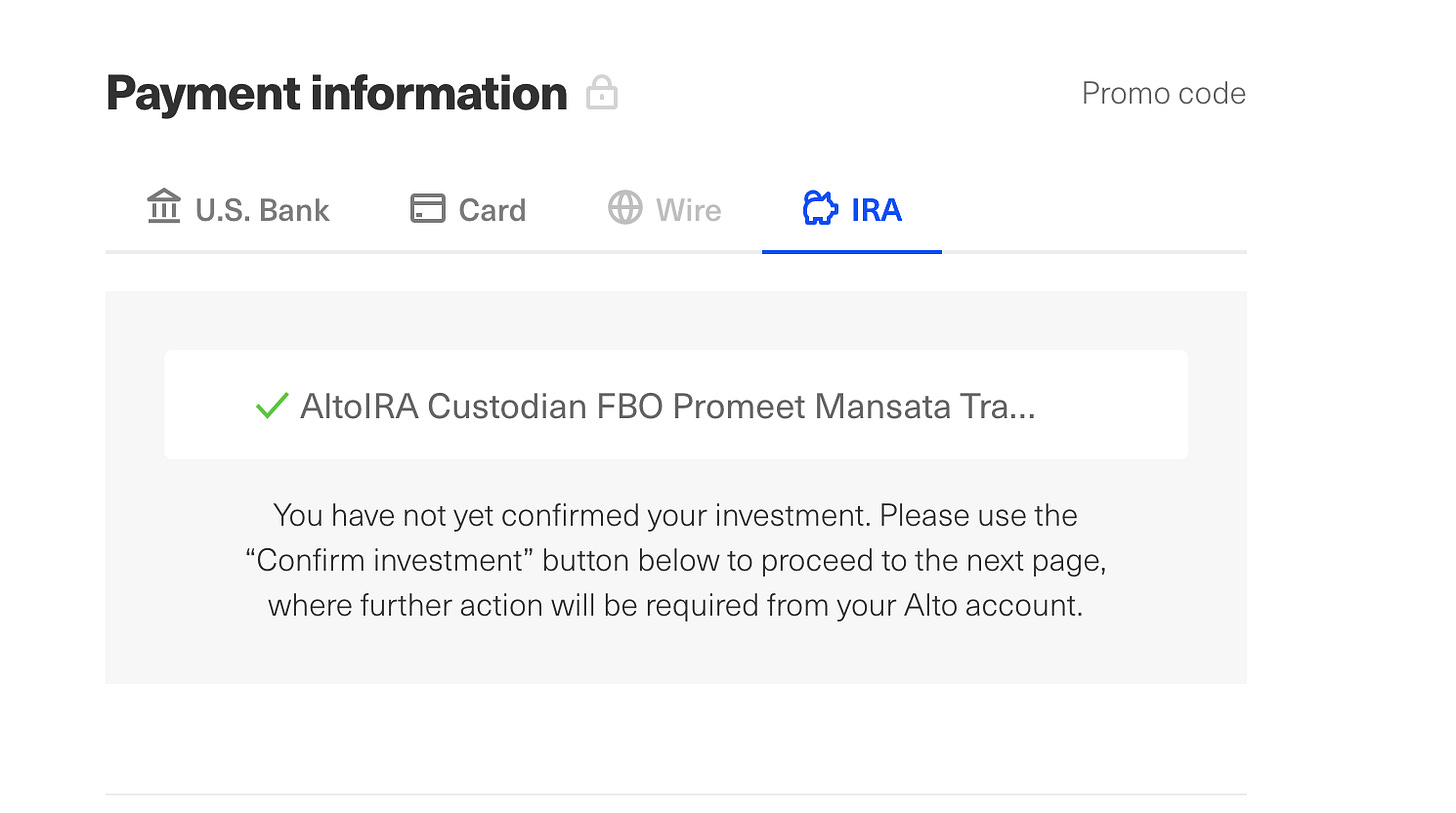

I can invest by clicking the Invest button and pay via Bank, Card, Wire, or my IRA

As you can see my Alto IRA custodial account is linked and I can invest with a click

There is some work left in AltoIRA so once you go back to AltoIRA you will see some docs to be signed as well as the status of your investments (Mine are below!, small fry)

That, in a nutshell, was my experience with these two platforms and it was mostly smooth and easy. Of course be careful what you invest in since it is a huge risk. Overall I think there are some interesting trends that we’ll see in 2022 as far as Angel investing goes

Everyone is an Solo Angel

That LNKD headline with “Angel Investor” does not make you part of the cool club anymore. Sorry bud. More and more people are going to become small time Angel investors. I coined the term Solo Angel but not sure if such people are called Individual Angels or something else

International Products

We’re going to see similar products that allow you to invest in startups internationally; these might be a bit more manual/risky but this will happen

Friend Angel

I have often wanted to invest on behalf of my friends (Similar to Composer where I create a portfolio) and people can invest really small amounts into my Solo Angel portfolio. I think there are some legal restrictions to investing this way but I can totally envision a situation where I can start a fund on, say Republic, invite friends to pool $ together and invest on their behalf instead of them finding investments. The platform of course will provide simple automated reporting on a monthly/quarterly basis with current value/details on the investments in addition to any other details that the Solo Angels would need. This is similar to Angel investing except a lot of it is automated away and cheaper to join as an investor (and perhaps even leave? I don’t know that remains to be seen)

Happy Solo Angel-ing and I hope this was somewhat useful!

Stay safe, be well and thank you for reading.