Apple's Bundling Strategy : Apple One

A look at Apple's potential services bundle and thoughts on this

This past week, Mark Gurman of Bloomberg wrote an article on a possible upcoming Apple bundle called “Apple One” that in its current form frankly makes no sense to me. From the article:

There will be different tiers, according to the people, who asked not to be identified discussing private plans. A basic package will include Apple Music and Apple TV+, while a more expensive variation will have those two services and the Apple Arcade gaming service. The next tier will add Apple News+, followed by a pricier bundle with extra iCloud storage for files and photos.

The article further mentions the below and compares it to Prime.

But the goal is to offer groups of services at lower prices than would be charged if consumers subscribed to each offering individually.

The article also talks about how it will bundle:

At first, Apple doesn’t plan to integrate the bundles with services such as AppleCare support or monthly payment plans for hardware like the iPhone or Mac. Earlier this year, as part of the Apple Card, Apple started offering monthly payments with no interest for several of its devices.

And

The new bundles will be geared toward families, meaning they will work with Apple’s Family Sharing system that provides access to as many as six people for each service. The offerings are designed to save consumers about $2 to upwards of $5 a month, depending on the package chosen. For example, if a family subscribes today to all of Apple’s major services plus the highest iCloud storage tier, that would cost about $45 a month. A new bundle could knock more than $5 off that.

There are several things wrong with this bundle strategy, but I think the first thing is to look at bundle strategies. But first what is a bundle? A bundle is nothing but a combination of products at a lower price. There are several ways to bundle:

Bundle related products (you need both anyway)

An example of this would be shaving cream plus shaving blades. You need both products so a bundle makes great sense for the consumer. Buy a Shaving Cream at $5 or Blades at $5 separately and buy them together for $9. The consumer is happy. The producer is happy (lower inventory costs. This essentially would generate Producer Surplus and Consumer Surplus and the pricing would determine who gets how much of surplus

Bundle that includes one primary product plus multiple secondary products.

A great example of this would be Amazon Prime. Remember the main reason people buy Amazon Prime is for the shipping. Not the music, arguably not for Amazon Prime Video (though I’m sure there are people who choose this option at $8.99/ month - Not sure this option still exists)

From : Amazon Prime Video Pricing Explained: Should You Go All-In Or Standalone?

A standalone Prime Video membership is not any different to the full Prime membership-included version with the same features and benefits on offer. However, this is a much more affordable option without the added benefit baggage as Amazon only charges $8.99 per month for the standalone version.

The logic here for Amazon is a signal. Their best (primary) product is not video, its shipping so by pricing this at $8.99 (for Prime Video only) as opposed to $12.99 for everything (which is a lot of stuff). Amazon figures that for $3 more we’ll give you music, free delivery etc etc and hook you on to the ecosystem. Once you get free shipping it’s like a regular drug and Amazon shows you how much you save if you cancel. So the key is to have a driver in the bundle (Media sports bundles are similar)

Bundle non related that include multiple somewhat equally weighted products.

I think a really good example of this would be cell phone prices today. You need voice, text and data (or at least most people do) and so they bundle varying levels of these v/s making them separate add on’s (they also have add-on products of course)

I want to take a quick detour here to a blog post from Chris Dixon on how bundling benefits both sellers and buyers. From How bundling benefits sellers and buyers, Its a small article and almost all of it reproduced below:

Consider the following simple model for the willingness-to-pay of two cable buyers, the “sports lover” and the “history lover”:

What price should the cable companies charge to maximize revenues? Note that optimal prices are always somewhere below the buyers’ willingness-to-pay. Otherwise the buyer wouldn’t benefit from the purchase. For simplicity, assume prices are set 10% lower than willingness-to-pay. If ESPN and the History Channel were sold individually, the revenue maximizing price would be $9 ($10 with a 10% discount). Sports lovers would buy ESPN and history lovers would buy the History Channel. The cable company would get $18 in revenue.

By bundling channels, the cable company can charge each customer $11.70 ($13 discounted 10%) for the bundle, yielding combined revenue of $23.40. The consumer surplus would be $2 in the non-bundle and $2.60 in the bundle. Thus both buyers and sellers benefit from bundling.

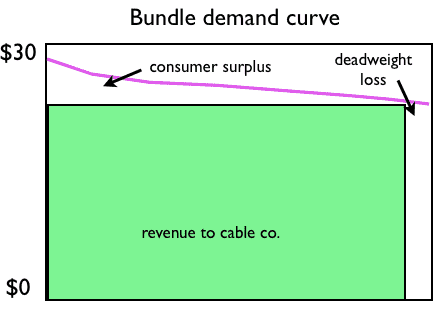

This model is obviously dramatically oversimplified. In real life, bundling tends to flatten the demand curve (here is some background on demand curves, and here is academic paper that presents this argument in rigorous mathematical terms). Suppose the demand curves for ESPN and the History Channel look like this:

The green boxes represent revenue for the seller. The deadweight loss areas to the right of the green boxes are transactions that would have benefited buyers and sellers but are not occurring because the revenue-maximizing prices are set too high.

Now consider what happens when you bundle channels. The key assumption is that individual buyers lie on different x-axis points of the demand curves of different channels. Sports lovers lie on the left of the ESPN demand curve but on the right side of the History Channel curve. To aggregate demand curves, you don’t stack one on top of the other. You add consumers’ willingness-to-pay separately for each channel.

Using the above simplified model, the two demand curves that go from $10 to $3 become one curve that stays flat at $13. In general, adding the individual demand curves creates a flatter demand curve:

A flatter demand curve lets sellers charge prices that capture larger areas under the curve and pass more surplus back to consumers. The only loser is the deadweight loss area.

What all can Apple Bundle today? (For simplicity I will leave out laptops, accessories, desktops)

Apple has two different plays here.

A hardware + services play (examples are above)

Apple already does some of this when they bundle (mostly for adoption) rather than due to popularity of the product. None of Apple’s software services compares with best in class competition (Apple TV+ : Netflix or Amazon Prime, Apple Music : Spotify or Pandora). This bundling strategy might work because defaults work. The obvious problem with this is that Spotify is already balking about the Apple Store commission and they even have a website dedicated to it and Apple will consider (in iOS14) allow defaults to be changed. They’ll need to price this bundle very carefully to avoid antitrust issues.

A services only play

This of course is what Mark Gurman alluded to. The problem is Apple has no killer (Music is the only comparable) service so bundling Music, Arcade, News, Cloud, TV+ is at best a bundle with products that are not the best, so the bundling strategy that Chris Dixon has written about above might work if music is the “killer” product.

The pricing has to be compelling enough for me to buy the whole lot (Given how other products are priced and the total pricing for Apple’s products ala carte is $31 the pricing would need to be $10-$12 (single) and $12-$17 (family of 6) in order for this bundle to work out. I’m a bit skeptical about this. Also remember that such bundling has the challenge of being anti competitive (if the product is sold at less than cost)

It is kinda clear what the problem above it. No producer surplus and unlikely any consumer surplus (or very little if any)

Options for Apple

Create a killer service (Music can be made more “killer?”)

Needless to say they are already trying this and services is a HUGE driver for Apple’s profit/services narrative ($13.3B in Q2/20). If I am reading this statista chart correctly (and I probably am), Apple makes $13-14B from App Store, ~3-5B from iTunes Store, $8-$10B from licensing (Google TAC). All in all Apple music has about 65-70M subs at lets say a blended average price of $8 - free for some months, free for students, bundled somewhere etc) resulting in ~$5.6B/mon - so nothing to sniff at!

The whole enchilada

I think though what Apple will do is bundle everything together (Hardware,Software, Services, Finance products, insurance products -- and obscure the price for each hardware line - iPhone, iPad, Airpods, Apple TV etc)

This serves two purposes

In the short run, Apple can bundle everything and “hide” the pricing somewhat so its not clear what the user is and isn’t getting (App store anti-competitive complaints still remain)

In the long run, Apple can use this strategy to force replacement phones. Most users wont care too much for an extra few bucks to get the “latest”

Apple obviously has plans to do this and the name “Apple One” definitely brings it home. Can’t wait to see how this plays out. Comments or questions? Ask away!

Thank you for reading, stay safe. Be well!